Do you really dislike (or even “h” word) budgeting? That’s me. If you’re like me too, then you may like the concept of reverse budgeting. After numerous attempts at “traditional” budgeting, I started doing a form of reverse budgeting, without even realizing it was a thing. Today on the blog, I’m sharing various simple budgeting tips for people who don’t like budgeting (if that’s you too).

What is reverse budgeting?

“The reverse budget is a simple spending plan that turns the traditional budget on its head. Rather than focusing on bills and other expenses first, it dictates you save before you take care of any other expense.” – from this blog on moneykey.com

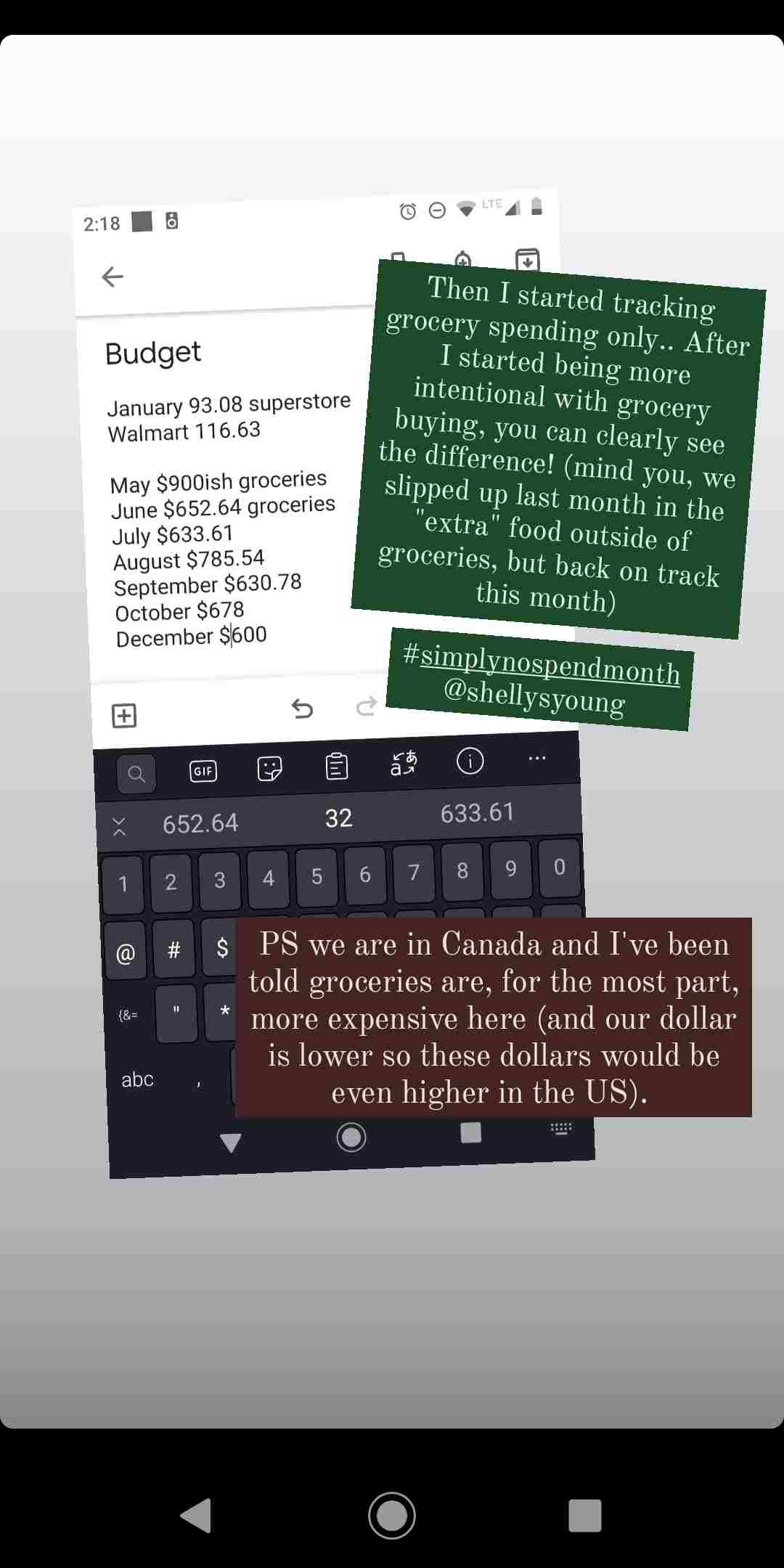

Our modified reverse budgeting is that we just track our purchases instead, helping us to get real with ourselves about our spending habits. It worked for us! So often we’d just dip into a category of our traditional budget or another one that had a bit left for some mindless spending. Tracking our purchases on paper taught us to become more mindful of what we purchased and to pause and think before purchasing. It also helped us see that whoa we need to get better at grocery budgeting too! And in turn, started saving us at least a couple hundred/month going forward. See details below.

Five Simple Budgeting Tips for People who Don’t Like Budgeting

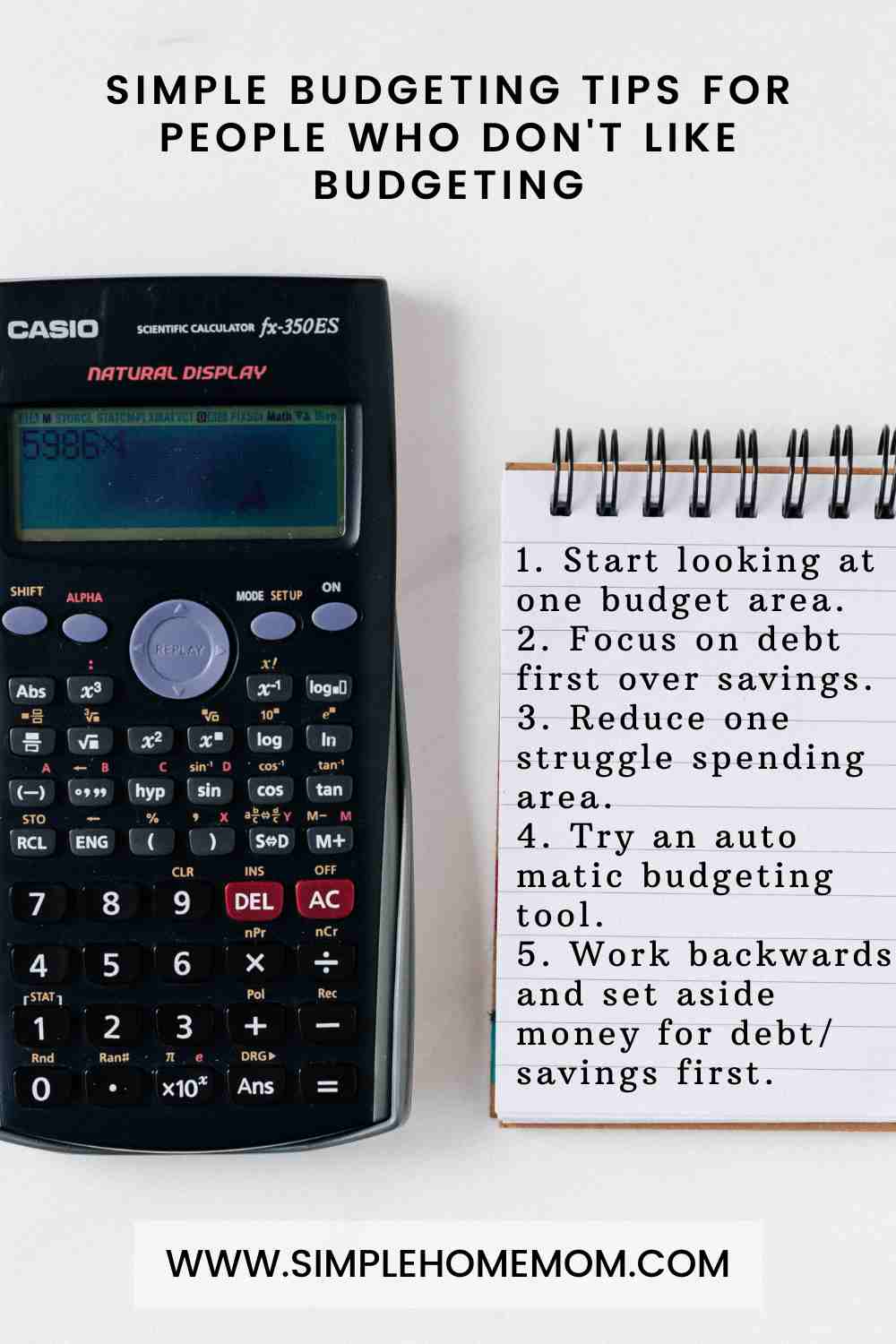

- Start looking at one budget area. If looking at the whole budget is overwhelming to you, then looking at one area at a time may be a good strategy. The biggest one for us would be groceries, but for you, it may be something like take out or coffee purchases outside of the home as a couple ideas.

- Focus on debt first over savings. Dave Ramsey and his “7 baby steps” to take control of your money…. suggests to tackle debt first to have that done and gone instead of spreading ourselves thin in both debt and savings.

- Reduce one struggle spending area. That, for us, is often in the food category. Track your spending for a month and I bet it’ll be telling of your struggle spending areas too. Click here for a free spending tracker within the free zero spend month I’m sharing with my mail list.

- Try a budgeting app. It can help simplify budgeting, especially if you’ve never done one before.

- Work backwards and set aside money for debt/savings first. Instead of allotting money into each category at the beginning of the month, you take the debt/savings at the beginning of the month right away and set that aside.

And if this sounds interesting to you and you’d like to try simple budgeting. I linked a “Plan Your Zero Spend Month” worksheets for you if you’d like to try a zero spend month that you can download here. The worksheets will be helpful if you you’re like me, as mentioned, and don’t like budgeting.

What’s included in the zero spend month worksheets?

- Some background information on what a zero spend month is.

- Examples.

- Planning Your Own Zero Spend Month worksheet: Five questions to help you design your own month.

- Spending tracker page for all expenses.

- Spending habit tracker (essentially to track the days you stick to zero spend)! So you can see your progess.

I’d also suggest reading my friend Shelly’s blog here with some more great tips: “5 No Spend Month Tips and Tricks”.

Other blogs of mine you may like:

· How to Do a Zero Spend Month that Works for You

· Five Tips to Have a Successful Zero Spend Month

· How to Create Minimal Wardrobes for Kids on a Budget

Here’s to more mindful spending!

Hi, I’m Kelly! I’m a mother of four children - three boys, one toddler girl - and our family lives on the beautiful east coast of Canada. I’m a past elementary teacher, turned stay at home, work at home mom eight years ago after I had my second child. I’ve found that the busier I’ve become and as my children age, that it’s become even more important to figure out what is most important to me and us as a family. Living a simpler lifestyle has helped us in so many ways in our home life - from better routines to faster tidying up times. It has been through my children that I have been inspired to learn how to effectively manage my time and to simplify in all areas of my home and life. I enjoy helping busy moms simplify home life by teaching flexible planning methods and skills. Enjoyed this blog and think it would be helpful to others? I'd love if you shared it. Thank you!